This article was penned by our partner firm: The Colony Group (TCG)

November 7, 2024

Add the United States to the chorus of countries that have ousted incumbents, electing a familiar outsider, Donald Trump, to return to the White House. The victory was decisive and, at the time of writing, appears to include both houses of Congress. The result was part of a global phenomenon – in every developed market election this year, the governing party lost share. The initial reactions from the financial markets are mixed. U.S. small- and mid-cap stocks rocketed higher, increasing more than 5%, while the rest of the domestic market enjoyed strong returns too. A stronger dollar offset gains in overseas equities for U.S. investors. More interesting, however, is the decline in Treasury bond prices as investors wrestle with the consequences of a higher deficit and other potentially inflationary policies promised by the President-Elect during the campaign.

We (TCG) wrote in September that it was too early to trade the election. We premised that on an unknown outcome, which is now resolved, and an uncertain legislative agenda based on whoever won the White House. Promises made on the campaign trail are often adapted as they plod through the gauntlet of congressional reviews. One need only look at the Affordable Care Act, which survived the last “red surge,” or the Tax Cut and Jobs Act, which remains a law despite a “blue wave” that ran on a platform committed to its repeal. Federal spending often benefits both blue and red districts, and once the money starts to flow, it becomes more difficult for politicians to vote to turn off the spigot to their own constituents. Biden-era programs, like the CHIPs Act or the Inflation Reduction Act, may prove too costly to repeal, even in some red districts, hopefully compelling policymakers to compromise.

So, what might investors expect over the course of President-Elect Trump’s second administration?

- As seen in his first term, we anticipate that tax policy will be a priority. Reductions in corporate- and personal-tax rates are likely to boost both earnings and spending. On their own, these should be significant tailwinds to U.S. equity returns, particularly small- and mid-cap companies with predominantly U.S. revenues.

- Nevertheless, this effect could be offset by an increase in tariffs and/or a rapid deportation of undocumented workers. Arguably, tariffs increase prices on imported goods and materials that are passed on to consumers. Moreover, reducing the number of available workers through deportation programs could destabilize the labor market, which has only recently come back into balance.

- There is an expectation of a looser regulatory environment, creating winners and losers. Energy permitting is likely to be fast tracked, allowing for more exploration and production, although we note that an increase in supply may lower energy prices, compressing producers’ profit margins. Merger & acquisition lawyers may be salivating over a, presumably, easier antitrust environment, but we suspect that this will be nuanced. Domestic-oriented businesses are likely to have an easier path to success, while multinationals, particularly within the media industry, may face hurdles.

- Interest rates and, by extension, interest-sensitive asset classes; such as small-cap, utilities, and real estate; may face a more uncertain outlook. The day after the election, trading suggested that higher long-term interest rates are coming, even if the Fed continues to reduce the short end of the yield curve. While President-Elect Trump has signaled that he’d like more input on Fed rate decisions, it is the market, and not the Fed, that influences long-term yields. If true, this suggests that mortgage rates may stay elevated for the time being.

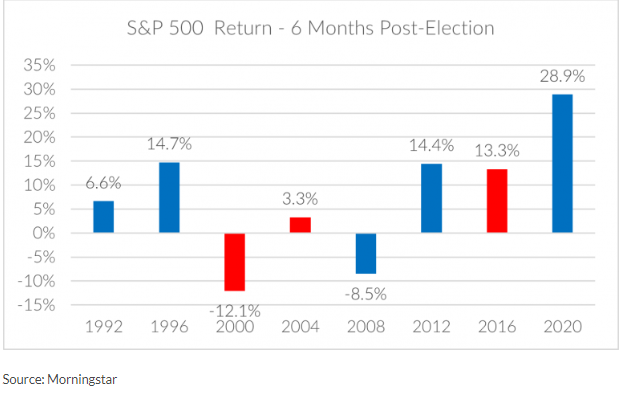

The most important thing for investors is that the election is now behind us. Markets have typically welcomed the end of the “silly season,” with positive returns over the subsequent six months. Notably, the two exceptions occurred during a period of non-political stress, in 2000 and 2008. This data contradicts the knee-jerk reactions often experienced the day after the election. Crossing an item off the list of known unknowns has historically boosted investor sentiment.

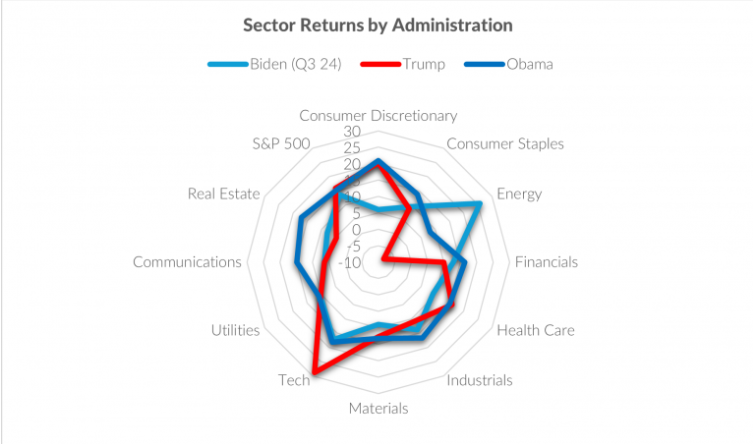

S&P 500 returns are usually positive regardless of political control. Under President Biden, the S&P 500 has risen an average of 13.6% per year (through 9/30), compared with returns of 16.0% and 15.8% for Trump’s and Obama’s terms, respectively. In fact, the S&P 500 has averaged double-digit returns under nearly every president since 1980, except George W. Bush, who faced both the Dot.Com bubble and the start of the War on Terror.

This consistency can be seen at the sector level as well. Under both Obama and Trump, the top-performing S&P 500 sectors were technology and consumer discretionary. Neither President deserves credit for these companies’ innovation or strong earnings growth. Similarly, we wouldn’t associate the secular decline of the energy sector on either President. Nevertheless, the highest returning sector under President Biden has been traditional energy, which is difficult to reconcile with his campaign promises.

Source: Morningstar, S&P 500 GICS Sectors

As investors move forward and leave behind whatever emotional response the election triggered, we believe that it is important to base our investment decisions on economic and market fundamentals. As it happens, the economy remains resilient, company earnings are growing, and the Fed has begun readjusting rates downward towards their estimation of the neutral rate. In our view, irrational investor behavior is more dangerous to the success of a financial plan than short-term market performance, and we recommend fighting the urge to react after events happen. While most politicians would not like to admit it, markets tend to advance in spite of political events, rather than because of them.

Disclosures:

On 09/01/24, HoyleCohen, LLC (“HoyleCohen”) merged with and into The Colony Group (“Colony”). Clients of HoyleCohen assigned their advisory agreements to Colony. The Colony Group, LLC (“Colony”) is an SEC Registered Investment Advisor with offices throughout the country. Registration does not imply that the SEC has endorsed or approved the qualifications of Colony or its respective representatives to provide advisory services. Colony provides individuals and institutions with personalized investment and financial advisory services.

The information in this communication is educational and general in nature and is not intended to be, nor should it be construed as, specific investment, tax, or legal advice. The charts and accompanying analysis are provided for the illustrative purpose of general market commentary. Individuals should seek advice from their wealth advisor or other tax advisors before undertaking actions in response to the matters discussed. No client or prospective should assume the above information serves as the receipt of, or substitute for, personalized individual advice. Market returns presented above are gross of fees.

This communication represents the opinions of HoyleCohen/Colony, may contain forward-looking statements, and presents information that may change due to market conditions or other factors. Nothing contained in this presentation may be relied upon as a guarantee, promise, assurance, or representation as to the future. Past performance is no guarantee of future results. Market conditions can vary widely overtime, and certain market and economic events having a positive impact on performance may not repeat themselves. Investment involves risk, including, but not limited to, loss of principal. HoyleCohen/Colony’s opinions may change over time due to market conditions and other factors.

This communication is prepared using third party sources. HoyleCohen/Colony considers these sources to be reliable; however, it cannot guarantee the accuracy or completeness of the information received.

HoyleCohen/Colony’s services offered are provided pursuant to an advisory agreement with the client. HoyleCohen/Colony’s Form ADV Part 2A, 2B, Form CRS, and Privacy Statement will be provided on request and as required by law. For a description of fees payable for investment advisory services, please see HoyleCohen/Colony’s Form ADV Part 2A.