Every year, the Internal Revenue Service announces cost-of-living adjustments that affect contribution limits for retirement plans and various tax deduction, exclusion, exemption, and threshold amounts. Here are a few of the key adjustments for 2020.

Employer Retirement Plans

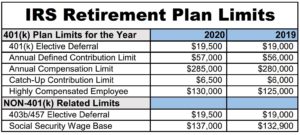

- Employees who participate in 401(k), 403(b), and most 457 plans can defer up to $19,500 in compensation in 2020 (up from $19,000 in 2019); employees age 50 and older can defer up to an additional $6,500 (up to $26,000) in 2020 (up from$6,000 in 2019).

- Employees participating in a SIMPLE retirement plan can defer up to $13,500 in 2020 (up from $13,000 in 2019), and employees age 50 and older can defer up to an additional $3,000 (up to $16,500) in 2020 (the same as in 2019).

- Employees participating in Defined Contribution Plans (SEP/IRA, Profit Sharing, Money Purchase, 401k) can defer up to $57,000 in 2020, and those age 50 and older can defer up to an additional $6,500 (up to $63,500).

IRA’s

The combined annual limit on contributions to traditional and Roth IRAs is $6,000 in 2020 (the same as in 2019), with individuals age 50 and older able to contribute an additional $1,000 (up to $7,000).

For individuals who are covered by a workplace retirement plan, the deduction for contributions to a traditional IRA phases out for the following modified adjusted gross income (MAGI) ranges (in dollars):

2019 2020

Single/Head of Household 64,000-74,000 65,000-75,000

Married filing jointly 103,000-123,000 104,000-124,000

Married filing separately 0-10,000 0-10,000

Note: The 2020 phaseout range is $196,000 -$206,000 (up from $193,000 – $203,000 in 2019) when the individual making the IRA contribution is not covered by a workplace retirement plan but is filing jointly with a spouse who is covered.

The modified adjusted gross income phaseout ranges for individuals to make contributions to a Roth IRA are:

2019 2020

Single/Head of Household 122,000-137,000 124,000-139,000

Married filing jointly 193,000-203,000 196,000-206,000

Married filing separately 0-10,000 0-10,000

Estate and gift tax

- The annual gift tax exclusion for 2020 is $15,000, the same as in 2019.

- The gift and estate tax basic exclusion amount for 2020 is $11,580,000, up from $11,400,000 in 2019.

Click here for a printable pdf of all Key Retirement & Tax Numbers for 2020.

* Please note that you should consult with your accountant prior to funding any retirement plan to verify your income eligibility and what plan would be most suitable for you.