January 2020 Market & Economic Update

By Peter Mueller

What a difference a year makes!

2019 proved to be a banner year for global investors with market sentiment and stock prices rallying off the lows of December 2018 and posting record highs in December 2019. The primary driver of returns was the “easy money” policy shifts at central banks around the world with governments lowering interest rates and adding liquidity to the financial system thereby boosting stock and bond prices. Here at home, the Federal Reserve reversed course from a rising interest rate policy in 2018 to cutting rates 3 times in 2019 to support economic growth. Adding fuel to the economy and stock valuations, the Fed also restarted its asset purchase program (quantitative easing) in the Fall which added more liquidity to the financial system thereby lifting stock and bond values further. These important monetary undercurrents continue today which should remain supportive of asset prices in 2020.

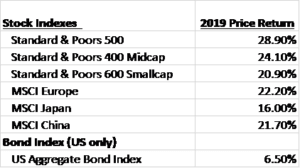

Below are market index returns for 2019 which highlight the strong results achieved across key global markets:

As the 4th quarter 2019 momentum carried over into the first few weeks of 2020, we expect the trajectory of returns to remain positive but also to moderate this year as earnings grow into valuations. In 2019, corporate earnings were flat to down. However, earnings are poised to grow this year. Improving corporate fundamentals coupled with a strong consumer (low unemployment, low inflation rates, and improved household wealth due to housing and stock price increases) should add further support to investor sentiment this year. While we experienced strong gains in stock markets in 2019, the gains were mainly attributed to growth in valuations (renewed optimism) and not fundamental earnings growth. By contrast, this year should see rising corporate earnings growth of roughly 6% and modest valuation increases as businesses “grow” into their elevated valuations. Based on S&P 500 earnings estimates for 2020 of roughly $180 per share and a price to earnings multiple target of 19 times earnings, markets may begin to target 3,425 on the S&P 500 (a target range about 3% above current levels). This implies an expected total return (appreciation + dividends) for stocks this year of 7% to 8% which is slightly below historical norms but would still far outpace inflation of 1.6% and the risk-free 10 Year US Treasury Note of 1.73%. As a result, stocks will continue to be an important component in your portfolio.

Today’s political environment continues to play a significant role in shifting market sentiment which often results in market volatility spikes. The key political headlines that affect market direction today continue to be trade related. As the trade picture was very much on and off again in 2019, markets were whipsawed with frequent changes and uncertain direction. Fortunately, trade related news brightened at year end as China and the US reached a “Phase 1” trade deal which stabilized relations and sharpened the visibility of future economic outcomes. This significantly improved market sentiment and clarity which has been one of the key catalysts in the recent stock market ascent. Phase 1 of the trade deal was signed by China and US on January 15th. Markets and business leaders now look forward to “Phase 2” which would focus on the tougher differences such as intellectual property protection and cyber-security protocols – this will be tackled after the election.

In sum, we anticipate that 2020 will be a pivotal year in the markets as the expansion in corporate earnings allows stocks to grow into their valuations. Valuations being where they are, investor return for the year should be positive but modest relative to 2020. The political theater will continue to impact markets as we are in an election year. President Trump will do everything to keep the markets and economy elevated to cement a victory in November, but the election outcome – both anticipated and actual – will likely affect market volatility, particularly if anti-business sentiment takes hold. Adding more fuel to the economic engine, the Federal Reserve continues to stimulate economic growth via low interest rates and more importantly a renewed asset purchase program (adding liquidity to the markets while increasing the amount of assets held on the Fed’s balance sheet – now around $4.15 trillion and growing).

In-light-of today’s environment, it is important to stay true to long-term (3+ years) investment plans and maintain asset diversification to generate current income and potential capital appreciation. We will not stray from investing in high quality businesses and funds, and we will continue to maintain portfolio cash flow from stock dividends, bonds, real estate and alternative income opportunities.

We appreciate your continued confidence and support, and as always, please contact your Advisor if you have any questions or wish to discuss.

Sincerely,

Peter Mueller & Your HoyleCohen Team