Market & Economic Briefing

April 27, 2022

By, Stephen J. Taddie, CBE, CFM, & Peter Mueller, MBA, CFP®

Reversion to the Mean?

Asset price volatility has surged over the past week as investors adjust to tighter monetary policy from the Federal Reserve via larger interest rate increases and the pending quantitative tightening (QT) program that is scheduled to begin this spring. During QT, the Fed will allow its holdings of maturing securities to redeem and therefore begin the process of shrinking its $9 trillion balance sheet. These monetary policy changes coupled with the ongoing geopolitical instability in Europe and inflation pressures have been the catalysts for the market volatility and decline.

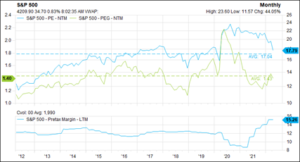

Chart 1

Assimilating these factors into market direction, it appears that the market is recalibrating its valuation levels lower – reverting back toward the 10-year average P/E (price to earnings) ratio. Chart 1 shows the market valuation retreating since mid-2020 as earnings recovered post-Covid, and more recently with the downdraft in stock prices. If we take today’s consensus S&P 500 EPS estimates at face value, $227.88 for 2022 and $250.05 for 2023, at the 10-year average P/E ratio, it equates to S&P 500 levels of 3,885 and 4,263 respectively.

With the S&P 500 at about 4,200, the market is trading at about a 7.5% premium to the 10-year average P/E ratio of 17.04. Granted, we are almost mid-way through 2022, and at some point, investors will begin to look more at 2023 earnings than 2022. This is where the Fed’s effort to stamp out inflation with monetary policy factors in. It is a high wire act of sorts, as tighter monetary policy designed to curb inflation will likely slow economic activity. This is precisely what many economists are now predicting here in the US and in other parts of the world. Of course, slower economic growth would impact S&P company earnings….That said, the same economists are predicting that the Fed will go from tightening in 2022 to easing in 2023 to restoke the economy that will have slowed due the Fed tightening.

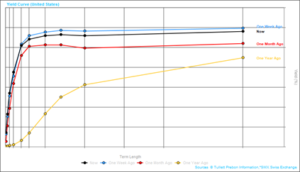

Chart 2

While US treasury yields have moved higher in the last 12 months. Most of the upward movement has been in shorter maturities (Chart 2), but the pain has been widespread, as prices for bonds of most any maturity have dropped. Should the Fed go from tightening in 2022 to easing in 2023, and a slowdown ensues, it may create a ceiling of sorts for longer-term bond yields. If so, we will likely continue playing a game of hide-and-seek with yield curve inversion, leading to a yield curve that is flat as a pancake. That would be a great outcome for longer-maturity bond holders.

Chart 3

Uncertainty and conjecture continue to play out in stock prices. On the bright side, companies are wonderful long-term profit machines, managing changes in costs and demand by adjusting operations, and/or passing on price increases to customers. It’s just the day-to-day changes in the valuation of those companies that get our attention. In a good way when valuations are up and in a bad way when valuations are down. For now, the recent bounce has faded, the market has fallen below its 250-day moving average (Chart 3), and the slog continues.

The discussions and opinions in this correspondence are for general information only and are not intended to provide investment advice. While taken from sources deemed to be accurate, HoyleCohen makes no representations about the accuracy of the information in the blog or its appropriateness for any given situation. HoyleCohen is a fiduciary acting on behalf of our clients. We are a fee-based investment advisor and do not receive commissions for any investment strategies of products that may be discussed. Any investment decisions should be discussed with your Advisor. Finally, all investments carry the risk of loss, including the permanent loss of principal and past performance is not a guarantee of future results.